For international inhabitants, this can be sophisticated if the deceased’s house nation’s regulations also influence the distribution of assets. It’s advisable to consult with a lawful professional who understands both equally Japanese and Intercontinental inheritance rules to precisely ascertain the rightful heirs.

Understanding these regulations is crucial for anybody embarking over a seek for an heir in Japan. This area will delve into the fundamentals of inheritance rights, the value of wills, And exactly how the law prioritizes heirs.

From dealing with unresponsive members of the family to navigating bureaucratic hurdles, this section addresses typical obstructions encountered during heir lookups in Japan and offers sensible suggestions for conquering these difficulties.

For international citizens (“外国人”), understanding which files are necessary might help avert delays and make sure a smoother technique. Beneath is an in depth listing of the key paperwork demanded when managing inheritance in Japan.

Japanese banks normally have demanding regulations regarding the transfer and liquidation of assets, significantly for non-citizens, so early session with economical establishments is sensible.

In the situation of a sound will, the estate will ordinarily be divided based on the wishes expressed in that could. 船橋 相続 However, when somebody dies with out a will, Japanese regulation dictates the distribution in the estate Amongst the legal heirs.

If mediation isn't going to do the job, the issue may perhaps should be taken to courtroom for a proper resolution. It is crucial for heirs to grasp their legal rights and obligations from the inheritance procedure, as disputes could cause delays and extra expenditures.

It’s vital to notice that inheritance tax in Japan might be larger than in many other international locations. As an example, an estate valued at ¥one hundred million (approximately $seven hundred,000 USD) can draw in a substantially bigger tax liability when compared with related estates in other jurisdictions.

Which means regardless of the deceased’s nationality or maybe the relevant inheritance regulations in their home country, Japanese law governs the division and ownership of any real residence in just Japan.

If foreign wills conflict Using these provisions, Japanese law may well just take precedence about Japanese property. Customers must tackle these prospective difficulties in their estate organizing.

Transfers of property and huge sums of cash could also be subject to added authorized or tax polices depending upon the countries involved. Guaranteeing all 船橋 相続 files are the right way submitted and lawfully compliant is important to finishing the procedure effortlessly.

Here's anonymized results tales and scenario experiments that illustrate the complexities and triumphs of searching for heirs in Japan.

A power of legal professional could be important if one or more heirs are not able to show up at inheritance proceedings in human being or if they wish to appoint another person to manage the inheritance procedure on their behalf.

Obstacle: With small details to go on along with the commonality on the sister’s title, finding her in a populous city like Kyoto gave the impression of getting a needle in a very haystack.

Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Michael Fishman Then & Now!

Michael Fishman Then & Now! Julia Stiles Then & Now!

Julia Stiles Then & Now! Tyra Banks Then & Now!

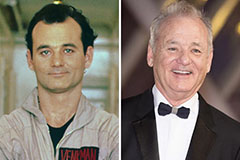

Tyra Banks Then & Now! Bill Murray Then & Now!

Bill Murray Then & Now!